As an institutional investor, we prioritize platforms that combine scalability, compliance, and liquidity. SunCrypto has met all three with consistent excellence. Their dedicated support and tailored onboarding process make crypto investing smooth and risk-managed. A reliable partner in the Indian digital asset space.

We've been routing client investments through SunCrypto for over two years now. The platform offers unmatched transparency, detailed reporting, and fast execution. Most importantly, their HNI relationship team is proactive and understands the nuances of large-volume crypto transactions.

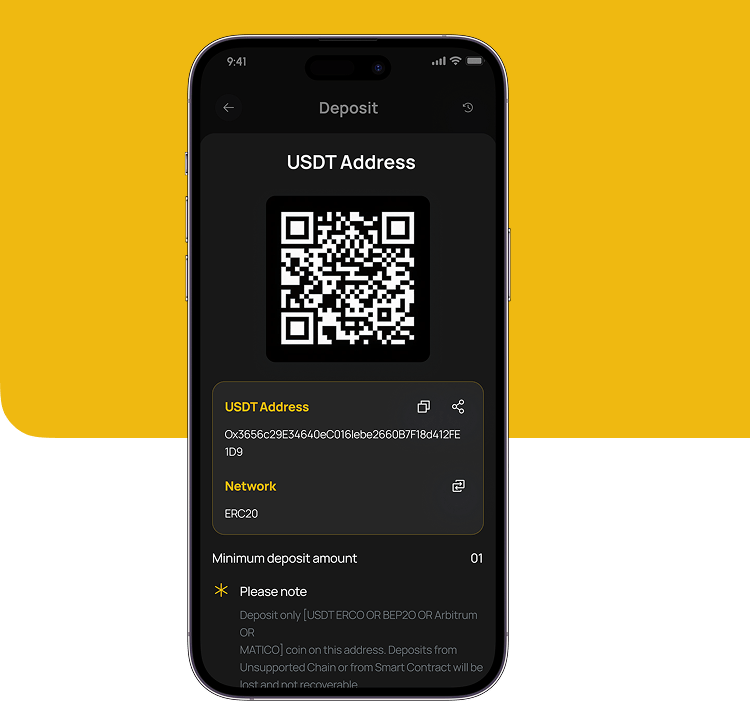

What sets SunCrypto apart is their personalized support and deep market access. As someone managing multi-crore portfolios, I need speed, clarity, and control — and SunCrypto delivers all three. The security of cold wallets and RM-level service makes them my preferred crypto partner.

HNI and Institutional Investors are increasingly active in the crypto market. While individuals once dominated, major financial institutions, pension funds, and hedge funds are now allocating portfolios to crypto, signifying its growing acceptance among sophisticated HNI and Institutional Investors globally.

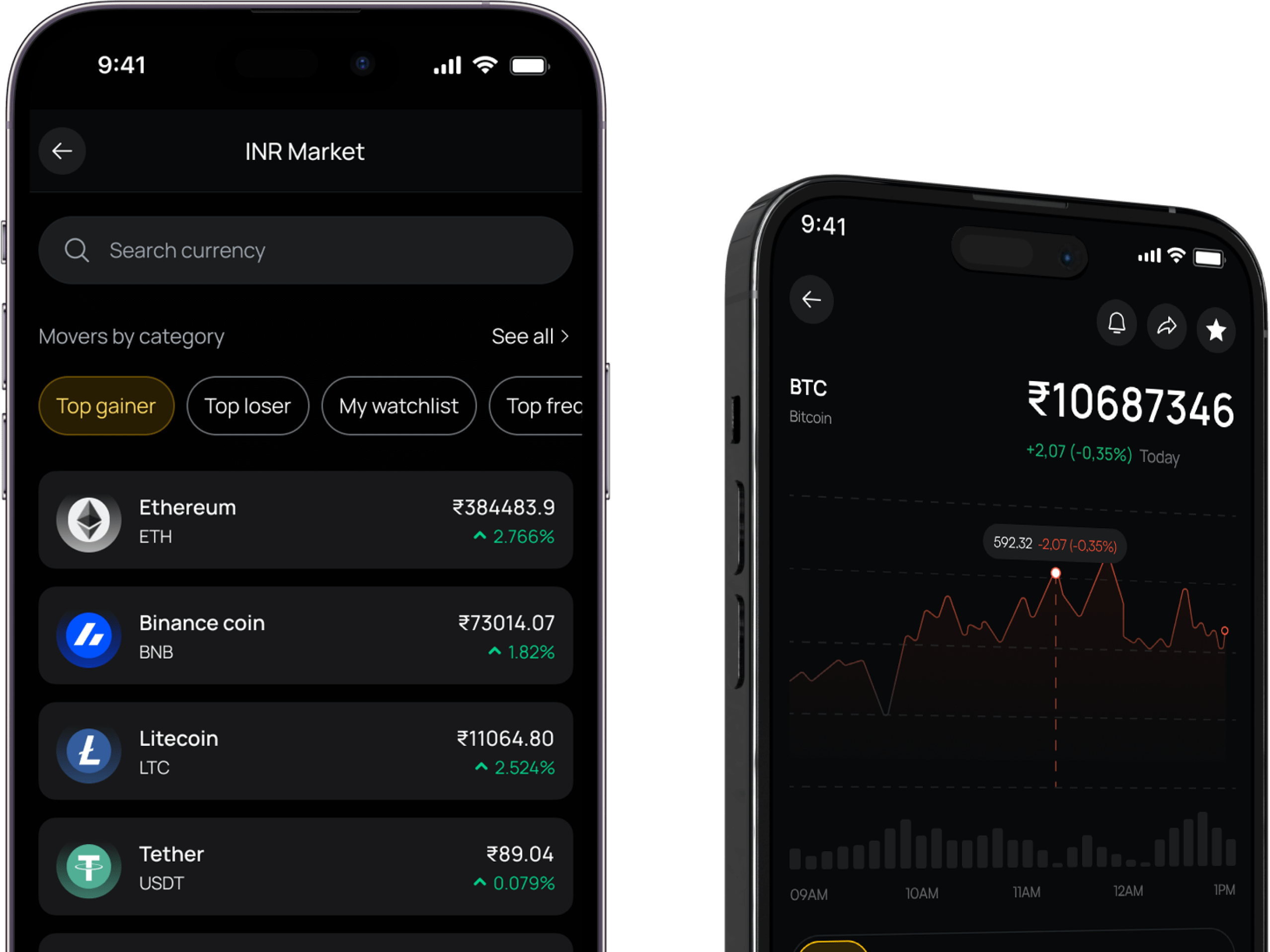

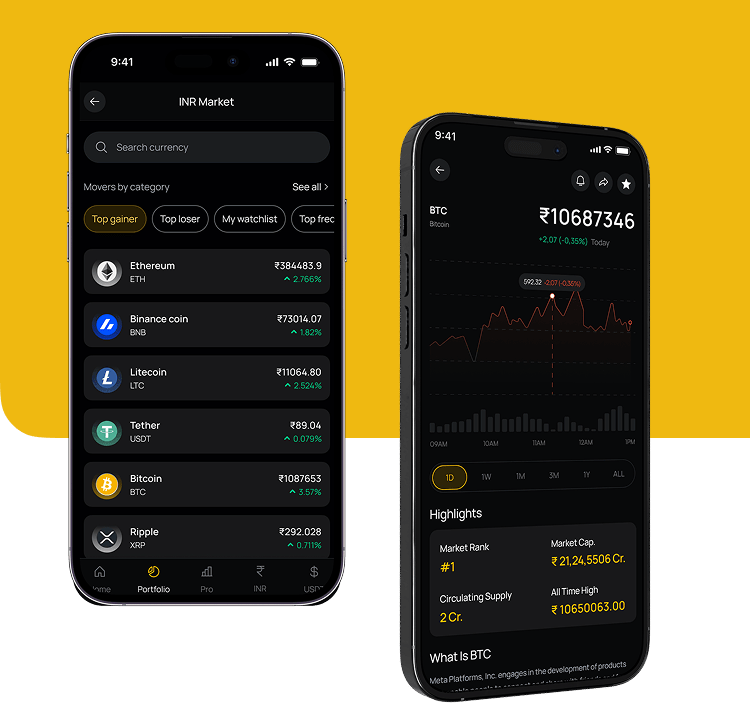

HNI and Institutional Investors primarily favor Bitcoin (BTC) as "digital gold" and Ethereum (ETH) for its DeFi ecosystem. Beyond these, they are also diversifying into large-cap altcoins like Binance Coin (BNB), Ripple (XRP), and Cardano (ADA), along with leading DeFi tokens such as Uniswap (UNI) and Aave (AAVE), and security tokens, continuously adapting their strategies.

Institutional adoption in crypto refers to the increasing involvement of large financial entities like banks, hedge funds, and corporations in the crypto market. This shift moves beyond individual investors, with more HNI and Institutional Investors in India and worldwide seeking the best platforms for crypto trading to explore this evolving asset class.

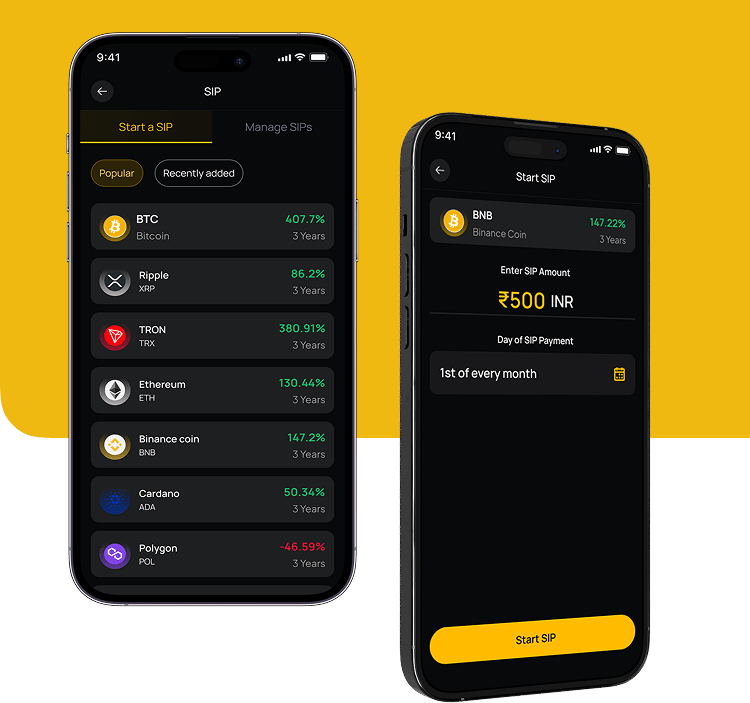

For HNI and Institutional Investors, crypto plays a significant role in diversifying portfolios due to its low correlation with traditional assets like stocks and bonds, offering exposure to a new, high-growth asset class. Cryptocurrencies can also act as a hedge against inflation and present potential for substantial returns, enhancing overall portfolio strategy.

Investing in crypto offers HNI and Institutional Investors several key benefits: potential for high returns, valuable diversification due to low correlation with traditional assets, inherent decentralization providing more control, accessibility with often smaller initial investments, innovation driven by blockchain technology, and its potential as a hedge against inflation, making it an attractive asset class.