For every trader engaging in high-leverage Futures contracts, there is one word that sends shivers down the spine: Liquidation. When using platforms like SunCrypto, where you can access leverage up to 75x, the potential for explosive profits is high, but so is the risk of a catastrophic loss.

This article, tailored for SunCrypto Futures users, breaks down exactly what liquidation is, why it occurs and provides a clear, zero-to-hero guide on controlling and mitigating this risk using the platform’s powerful tools.

What is Liquidation and Why Does It Happen?

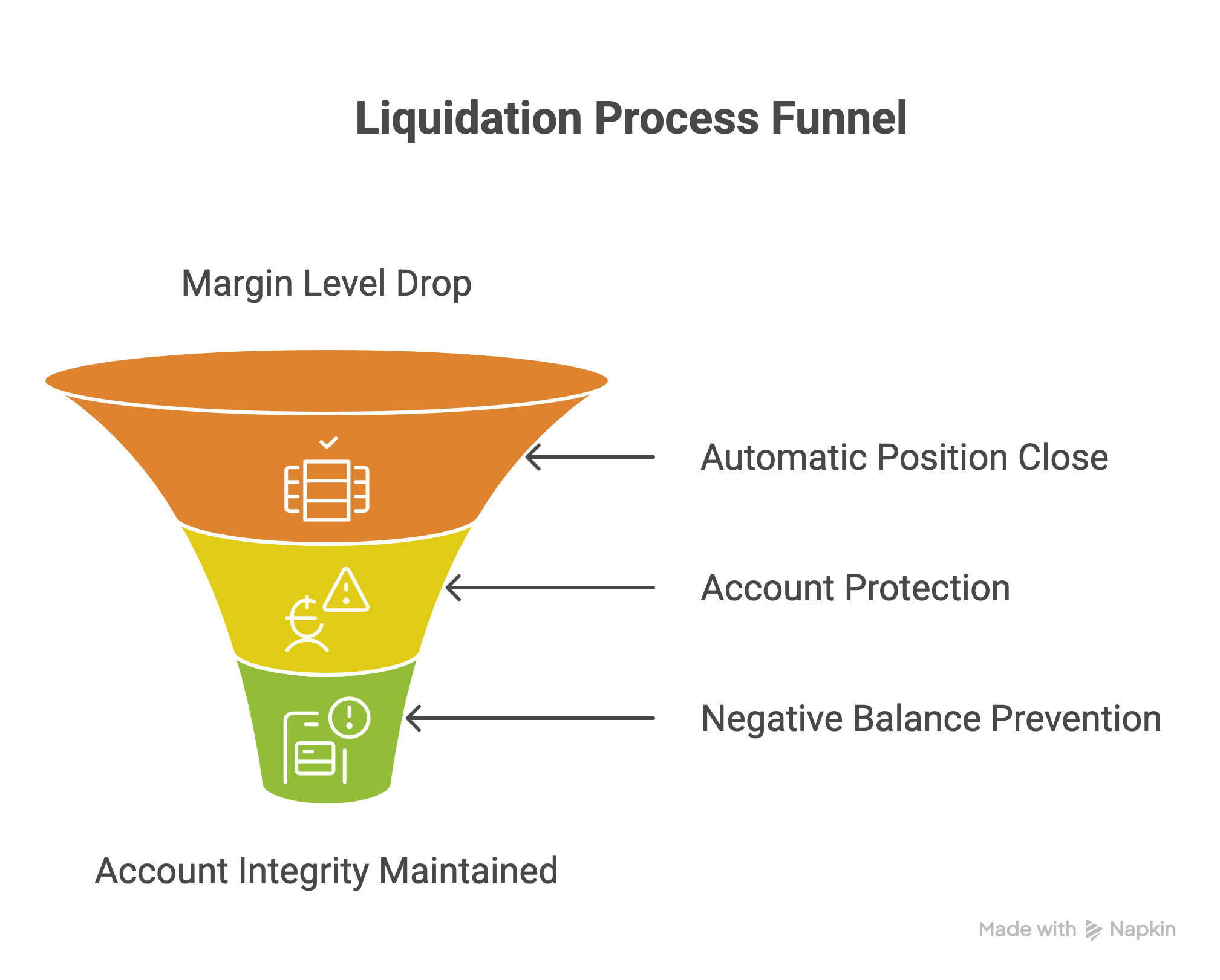

Liquidation is the automatic closure of your Futures position by the exchange. It occurs when your trade’s balance—the money you have placed as security (margin) minus the incurred losses—drops below the minimum maintenance margin required by the exchange. The exchange closes the position to prevent your loss from exceeding the funds available in your account.

Role of High Leverage In Liquidation

The primary driver of liquidation is the use of High Leverage.

When you use leverage, you are effectively taking a larger position than your capital allows. While this magnifies potential profit, it dramatically shrinks your margin for error, or loss tolerance. The market only needs to move a small percentage against you for your losses to wipe out your initial margin.

A Liquidation Example (BTC Long at $111,000):

| Leverage Used | Margin Required (Approx.) | Liquidation Price (Approx.) | Market Move to Trigger Loss |

| 10x | 10% of Position | $99,500 | Approx. 10% move against trade |

| 75x | 1.33% of Position | $109,000 | Approx. 1.75% move against trade |

As shown above, High Leverage brings the liquidation price alarmingly close to your entry price.

A minor market fluctuation can suddenly eliminate your entire capital.

The key takeaway is: Low Leverage = Low Risk = Liquidation Door is Farther.

Key Ways To Avoid Liquidation

The most critical tools for managing risk and combating liquidation on SunCrypto are the simple, yet effective, Stop Loss and Take Profit orders. These must be the foundation of your trading strategy.

1. Stop Loss (SL): The Loss Limiter

A Stop Loss order is a mandatory risk-limiting tool. It allows you to predefine the maximum loss you are willing to incur on any single trade (e.g., $100). If the asset price reaches your defined SL level, the exchange automatically executes a market order to close your position. This prevents a small loss from spiraling into a full account liquidation.

2. Take Profit (TP): The Profit Sealer

Take Profit is a tool to lock in your desired gains. You set a target price, and when the market reaches this level, the position automatically closes, securing your profit. This is especially useful for sealing profits when you are away from the screen.

Trading Tip: Always use a tight SL and TP. Aim for a Risk-to-Reward Ratio of at least 1:2 or 1:3 (meaning for every $1 of risk, you aim for $2 or $3 of profit).

Key Feature To Avoid Liquidation

Understanding Margin Type is vital, and this is where SunCrypto’s primary feature excels for retail traders.

SunCrypto utilizes the Isolated Margin Mode.

- Isolated Margin (Best for Risk Control): In this mode, the margin for each trade is entirely separate and isolated from your main Future Wallet balance. If you allocate $1,000 to a trade, your maximum loss is strictly limited to that $1,000. Your remaining funds in the wallet are safe and cannot be used to cover the loss of that position. This makes it the safest option for controlling liquidation risk on a per-trade basis.

- Cross Margin (Not Recommended for Beginners): This mode uses your entire available wallet balance as collateral for a single trade. While it pushes the liquidation price further away, if the trade moves extremely against you, the loss could liquidate your entire wallet. Always choose Isolated Margin Mode on SunCrypto.

Smart Trading Features for Expert Management

SunCrypto’s platform also provides advanced features that can be used for sophisticated risk management and fast decision-making:

- Auto Margin: This feature acts as a last-second defense. If your position is close to liquidation and you have extra funds in your wallet, the system can be set to automatically add a small amount of margin to the losing position. This moves the liquidation price further away, giving the trade more room to recover.

- Reverse Margin: This is a crucial tool during market reversals. If you are currently Long (betting on a price rise) and the market suddenly crashes, the Reverse Margin feature allows you to instantly flip your position to Short (betting on a price fall) with a single click. This transforms a potential loss into a profit-making opportunity during a major trend change.

Final Thoughts

In Crypto Futures Trading, the key to long-term success is not maximizing leverage but mastering Risk Management. Liquidation is not an unavoidable force; it is a direct consequence of poor risk planning.

To confidently trade futures on SunCrypto and avoid liquidation:

- Keep Leverage Low: Trade with 10x to 20x to provide ample breathing room for market fluctuations.

- Set Tight SL/TP: Use Stop Loss and Take Profit on every single position.

- Choose Isolated Margin: Ensure your risk is limited to the capital allocated to that specific trade.

Your position size must always be determined by how much loss you can afford, not by how much profit you hope to make.