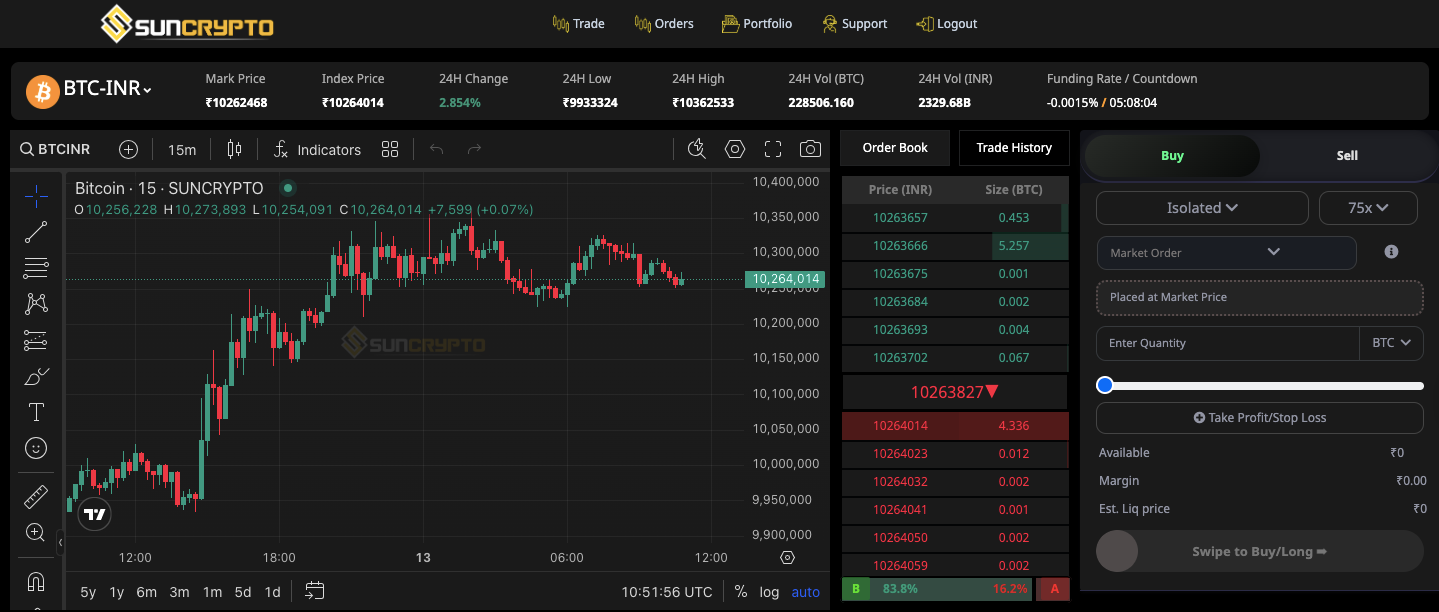

SunCrypto, a leading Indian crypto exchange, has launched the web version futures trading platform that combines the power of desktop computing with the flexibility of modern trading interfaces. The cryptocurrency trading industry continues to evolve rapidly, and the introduction of web version futures trading platforms represents a significant leap forward for traders seeking enhanced analytical capabilities and improved user experiences.

Understanding Web Version Futures Trading

Web version futures trading refers to the ability to execute leveraged cryptocurrency contracts directly through a web browser without downloading specialized software. Unlike traditional desktop applications that require installation and updates, web version futures trading platforms operate entirely within your browser, offering immediate access from any computer with an internet connection.

The shift toward web version futures trading addresses several limitations inherent to mobile-only platforms. While mobile apps excel at providing on-the-go market access, they struggle to deliver the comprehensive analytical environment that serious traders require. Web version futures trading solves this by providing larger screens for detailed chart analysis, multiple windows for simultaneous monitoring, and a more ergonomic setup for extended trading sessions.

For Indian traders specifically, web version futures trading platforms like SunCrypto’s offering have become essential tools. The combination of INR-denominated contracts, high leverage options, and the analytical power of desktop displays creates an environment where both novice and experienced traders can execute their strategies with precision.

Evolution of SunCrypto’s Web Version Futures Trading

SunCrypto’s journey toward comprehensive futures trading began approximately five months ago when the platform introduced futures trading capabilities to its mobile application. The initial launch featured impressive specifications: up to 75x leverage and over 600+ trading contracts available in both INR and USDT pairs, making it one of India’s most comprehensive futures trading offerings.

The mobile app version of futures trading quickly gained popularity among traders who appreciated the convenience of monitoring positions anywhere. However, as the user base expanded and trading strategies became more sophisticated, demand grew for a proper web version futures trading interface. Traders expressed clear needs: larger displays for technical analysis, the ability to manage multiple positions simultaneously, and a comfortable environment for day-long trading sessions.

Responding to this feedback, SunCrypto developed a full-featured web version futures trading platform that maintains all mobile app functionality while adding capabilities specifically designed for desktop environments. This wasn’t merely a mobile interface stretched to fit larger screens—it was a thoughtfully engineered web version futures trading solution built around how traders actually work at their desks.

Accessing SunCrypto’s Web Version Futures Trading Platform

Getting started with web version futures trading on SunCrypto is straightforward, requiring just a few minutes and no software downloads.

- Navigate to the Official Website Open any modern web browser—Chrome, Firefox, Safari, and Edge all support web version futures trading seamlessly—and visit https://suncrypto.in/. Always verify the URL to ensure you’re accessing the legitimate platform.

- Access the Trading Interface On the top navigation bar, click “TRADE” to reveal available trading options. This menu provides access to all trading products offered by SunCrypto.

- Select Web Version Futures Trading From the dropdown menu, select “Futures Trading.” This redirects you to the dedicated web version futures trading dashboard, your central hub for all leveraged trading activities.

- Secure Login Process Click the “Login” button and enter your registered mobile number—the same credentials used for the SunCrypto mobile app. You’ll receive an OTP via SMS for two-factor authentication, ensuring your web version futures trading account remains secure.

- Begin Trading Once authenticated, you gain full access to web version futures trading with all your account information, balances, and trading tools immediately available. The platform synchronizes seamlessly with your mobile app, so positions and balances update in real-time across both interfaces.

Exploring the Web Version Futures Trading Dashboard

The effectiveness of any web version futures trading platform depends on its interface design. SunCrypto’s dashboard excels by organizing complex information logically while maintaining visual clarity.

Primary Navigation for Web Version Futures Trading

The top navigation bar provides quick access to all essential web version futures trading functions:

- Market Switching: Toggle between Spot and Futures markets, allowing you to manage both leveraged positions and spot holdings from within the web version futures trading interface.

- Comprehensive Order Management: Access detailed information about your web version futures trading activity including position history, trade history, order history, and transaction history. This centralized record-keeping proves invaluable for analyzing your trading performance.

- Portfolio Monitoring: View account balances, available margin, and importantly, your Fee & VIP levels. SunCrypto’s enhanced tiered fee structure rewards active web version futures trading with reduced costs as your volume increases—a feature we’ll explore in detail later in this guide.

- Seamless Fund Transfers: Move funds instantly between Spot and Futures wallets without any transfer fees. This feature eliminates friction in capital allocation, allowing you to respond quickly to web version futures trading opportunities.

- Support Access: Get help when needed through multiple channels, whether you’re troubleshooting web version futures trading issues or have questions about specific features.

Market Data and Coin Selection

The coin selection panel beneath the SunCrypto logo displays all available contracts for web version futures trading. With over 600+ options across INR and USDT pairs, traders have extensive choices.

Selecting any coin in the web version futures trading interface immediately populates comprehensive market statistics:

- Mark Price & Index Price: Essential for understanding fair value in web version futures trading and assessing premium or discount to spot markets

- 24-Hour Performance: Quick visual reference for recent volatility and trend direction in your web version futures trading pairs

- Trading Volume: Indicates liquidity depth for your web version futures trading executions

- Funding Rate and Countdown: Critical information for web version futures trading position management, showing periodic payments between longs and shorts

Advanced Charting in Web Version Futures Trading

The charting capabilities distinguish professional web version futures trading platforms from basic mobile apps. SunCrypto’s implementation provides:

- Real-Time Price Charts: Continuously updating displays showing price movements across multiple timeframes, essential for effective web version futures trading analysis.

- Full-Screen Expansion: Transform your browser into a dedicated charting workspace, maximizing the analytical advantages of web version futures trading over mobile platforms.

- Technical Analysis Tools: Draw trendlines, identify patterns, and apply indicators that would be impractical on mobile screens. These tools make web version futures trading more precise and strategic.

The superior visibility offered by web version futures trading helps traders spot trends, reversals, and patterns that might be invisible on smaller displays, leading to better-informed trading decisions.

Order Book and Market Depth

The Order Book in the web version futures trading interface displays real-time pending orders at various price levels. This tool shows where other web version futures trading participants are positioning themselves, helping you identify potential support and resistance zones.

Market depth visualization in web version futures trading helps assess liquidity before placing large orders. Deep order books indicate you can execute sizable web version futures trading positions with minimal slippage, while thin books suggest caution with larger trades.

The Web Version Futures Trading Execution Panel

The Trading Panel serves as your primary interface for web version futures trading execution:

- Position Direction: Clearly labeled Buy (long) and Sell (short) buttons for straightforward web version futures trading execution.

- Margin Mode Selection: Choose between Isolated and Cross margin for your web version futures trading positions. Isolated margin protects your account by limiting risk to allocated funds, while Cross margin provides more flexibility by using your entire balance as collateral.

- Leverage Adjustment: Set leverage from 1x to 75x in the web version futures trading interface. Beginners should start with lower leverage (below 25x) while learning web version futures trading mechanics.

- Multiple Order Types: Execute web version futures trading strategies using Market orders (immediate execution), Limit orders (specified price), Stop Market orders (triggered execution), or Stop Limit orders (combined functionality).

- Trade Amount Input: Specify position sizes for your web version futures trading executions in terms of underlying assets or margin amounts.

USDT Auto-Conversion in Web Version Futures Trading

For USDT pairs in web version futures trading, SunCrypto implements automatic INR-to-USDT conversion at trade execution. This feature streamlines web version futures trading by eliminating manual conversion steps, allowing you to move from opportunity identification to execution rapidly.

Risk Management Tools for Web Version Futures Trading

Professional web version futures trading requires robust risk management, and SunCrypto delivers:

- Take Profit Orders: Set automatic profit-taking levels in your web version futures trading positions, ensuring gains are captured even when you’re not actively monitoring.

- Stop Loss Orders: Protect capital by specifying exit points that limit losses in web version futures trading, essential for long-term success.

The flexibility to set these parameters during initial web version futures trading execution or modify them afterward provides complete control over risk exposure. The interface displays profit/loss calculations upfront, helping maintain disciplined risk-reward ratios in your web version futures trading.

Position Management in Web Version Futures Trading

Below the charts, the Open Orders and Positions section provides comprehensive web version futures trading portfolio oversight:

- Active Position Monitoring: View all open web version futures trading positions with entry prices, current values, realized and unrealized P&L, and liquidation prices.

- Flexible Position Control: Close individual web version futures trading positions when targets are met, or use “Close All” for rapid portfolio management during volatile conditions.

- Order Queue Management: Track pending orders in your web version futures trading workflow, canceling or modifying them as market conditions evolve.

This consolidated view ensures you maintain complete awareness of all web version futures trading activity, a critical safety feature when managing multiple leveraged positions.

Executing Trades in Web Version Futures Trading

Understanding the complete workflow helps you maximize the potential of web version futures trading. Here’s a detailed walkthrough:

Step 1: Select Your Contract Choose which cryptocurrency you want for web version futures trading from the coin panel. For example, selecting BTC/INR loads all relevant data for Bitcoin futures trading against Indian Rupees.

Step 2: Analyze Using Web Version Futures Trading Tools Leverage the enhanced charting capabilities of web version futures trading to study trends. Are prices trending upward or downward? Consolidating in a range? Use technical indicators, pattern recognition, and the larger display to inform your web version futures trading decisions.

Check the Order Book to see where buying and selling pressure concentrates in the web version futures trading market. Review funding rates to understand positioning of other web version futures trading participants.

Step 3: Determine Direction Based on your analysis, decide whether to go long (buy) or short (sell) in your web version futures trading execution.

Step 4: Select Order Type Choose the order type that matches your web version futures trading strategy. Market orders provide immediate execution, while Limit orders allow you to specify exact entry prices for your web version futures trading positions.

Step 5: Configure Leverage Set your leverage multiplier carefully in the web version futures trading interface. Remember that while web version futures trading offers up to 75x leverage, beginners should use 25x or less. Many successful web version futures trading practitioners use just 2x-10x leverage, prioritizing capital preservation.

Step 6: Enter Position Size Input the amount for your web version futures trading position. The interface calculates how leverage affects your actual exposure in the web version futures trading market.

Step 7: Set Risk Parameters Before executing web version futures trading positions, establish Take Profit and Stop Loss levels. The web version futures trading interface calculates potential outcomes, helping you maintain proper risk-reward ratios.

Step 8: Execute Review all parameters in your web version futures trading setup, then click Buy or Sell. Your web version futures trading position appears immediately in the Positions tab.

Step 9: Monitor and Manage Track your web version futures trading position in real-time with continuously updating P&L. The web version futures trading interface makes modifications straightforward—adjust stop losses, close partial positions, or exit completely with clear buttons and confirmations.

Understanding SunCrypto’s Revolutionary Fee Structure for Web Version Futures Trading

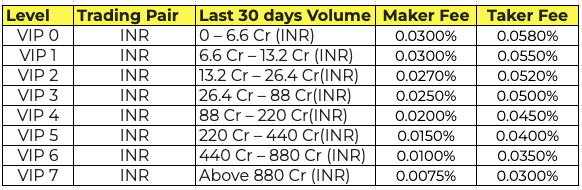

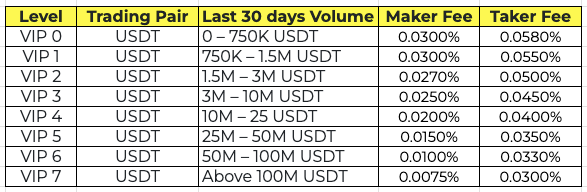

One of the most significant advantages of web version futures trading on SunCrypto is the platform’s newly redesigned fee structure, which makes professional trading more accessible and profitable for all users. This enhanced system represents a fundamental shift in how cryptocurrency exchanges reward their traders.

The New VIP Program: Lower Costs, Faster Progression

SunCrypto has introduced an improved fee structure that streamlines the VIP program across Levels 0 to 7, offering substantial discounts on maker and taker fees for both INR and USDT markets in web version futures trading.

The platform has dramatically lowered the 30-day trading volume requirements to maintain each VIP level by almost 10 times compared to the previous structure.

This transformation addresses a critical barrier that previously prevented regular traders from accessing lower fees. Under the old structure, reaching even VIP Level 0 required massive trading volume of over ₹17.6 crore, creating a significant barrier that made it difficult for dedicated traders to progress and earn fee reductions.

Key Benefits of the New Fee Structure

The enhanced fee structure delivers multiple advantages for web version futures trading:

- Easier VIP Progression: With significantly reduced volume requirements, traders can move up VIP levels and unlock benefits much faster than before.

- Greater Savings: Traders can enjoy up to a 77% trading fee discount at higher VIP levels, which directly increases net returns on every web version futures trading execution.

- More Frequent Rewards: Lower thresholds mean reaching new milestones and getting rewarded with fee deductions more quickly, making web version futures trading more profitable sooner.

- Better Risk Management: Lower fees allow traders to diversify positions without worrying about high costs, helping navigate volatile crypto markets with confidence during web version futures trading sessions.

Other Fee Types on SunCrypto

Beyond futures trading fees, understanding SunCrypto’s complete fee structure helps you manage overall trading costs:

- Spot Trading Fees: SunCrypto charges 0.5% on buy and sell transactions for spot trading, applicable to the majority of coins, with the fee inclusive of 18% GST.

- Withdrawal Fees: SunCrypto itself does not charge a withdrawal fee for moving crypto assets from your wallet to an external wallet. However, a separate network fee is charged to cover blockchain transaction costs.

The combination of zero internal transfer fees between Spot and Futures wallets, competitive spot trading fees, and the revolutionary tiered futures fee structure makes SunCrypto one of the most cost-effective platforms for comprehensive cryptocurrency trading in India.

Maximizing Fee Savings in Web Version Futures Trading

To take full advantage of the new fee structure during web version futures trading:

- Track Your Volume: Monitor your 30-day trading volume regularly through the Portfolio section of the web version futures trading dashboard. Understanding where you stand helps you plan to reach the next VIP level.

- Consider Maker Orders: When timing isn’t critical in your web version futures trading strategy, use limit orders instead of market orders. Maker fees are lower than taker fees, and over time, this difference can significantly impact your profitability.

- Plan Your Trading: If you’re close to the volume threshold for the next VIP level, consider whether additional web version futures trading activity makes economic sense. The fee savings at higher levels can justify strategic trading to reach those thresholds.

- Leverage Both Markets: Remember that trading volume in both INR and USDT markets counts toward your VIP level progression. Diversifying across both pairs in your web version futures trading can help you reach higher levels faster.

Advantages of Web Version Futures Trading on SunCrypto

SunCrypto’s web version futures trading platform offers several compelling benefits:

- Extensive Contract Selection: Over 600 contracts available for web version futures trading provides diversification opportunities across the cryptocurrency spectrum.

- Dual Currency Pairs: Web version futures trading in both INR and USDT pairs gives Indian traders genuine choice—trade in rupees for simplicity or USDT for broader access.

- High Leverage Options: Up to 75x leverage in web version futures trading allows experienced traders to amplify positions strategically while beginners can start conservatively.

- Revolutionary Fee Structure: The dramatically reduced volume requirements and up to 77% fee discounts make professional-level web version futures trading economics accessible to regular traders, not just institutional participants.

- Zero Transfer Fees: Instant, free transfers between Spot and Futures wallets encourage flexible capital allocation in web version futures trading.

- Direct INR Trading: Web version futures trading in rupees eliminates currency conversion hassles for Indian users—deposit, trade, and withdraw in the same currency.

- Comprehensive Risk Tools: Built-in TP and SL functionality in web version futures trading provides professional-grade risk management infrastructure.

- Intuitive Design: Despite advanced capabilities, the web version futures trading dashboard maintains clarity that serves both beginners and professionals.

- Reliable Support: When web version futures trading issues arise, comprehensive support channels ensure timely assistance.

- Platform Synchronization: Your web version futures trading account works seamlessly with the mobile app—positions and balances sync in real-time regardless of which platform you use.

Best Practices for Web Version Futures Trading Success

Maximizing the potential of web version futures trading requires adopting strategies suited to the desktop environment:

- Leverage Multiple Monitors: If available, dedicate screens to different aspects of web version futures trading—charts on one display, order management on another.

- Use the Expanded Display: Take full advantage of web version futures trading’s larger screen real estate. Draw trendlines, mark key levels, and use technical indicators that would be difficult on mobile.

- Maintain Trading Records: The comfortable environment of web version futures trading makes detailed journaling easier. Document your web version futures trading decisions, rationale, and outcomes for continuous improvement.

- Start Conservatively: Even experienced traders should begin with smaller positions when starting web version futures trading on a new platform. Gradually increase size as you become comfortable with the interface.

- Practice Discipline: The convenience of web version futures trading can encourage overtrading. Establish rules about maximum daily trades, position sizes, and risk per web version futures trading execution.

- Always Use Stop Losses: Web version futures trading without stop losses is unnecessarily risky. The interface makes setting these parameters easy—protect every position.

- Monitor Your VIP Level: Keep track of your trading volume and VIP progression. Understanding how close you are to the next fee tier can help you optimize your web version futures trading strategy for maximum cost efficiency.

- Stay Informed: Follow updates about new web version futures trading features, contract listings, or changes to trading parameters on the platform.

Common Web Version Futures Trading Mistakes to Avoid

Being aware of common pitfalls in web version futures trading helps you avoid costly errors:

- Overleveraging: Just because web version futures trading offers 75x leverage doesn’t mean you should use it. High leverage dramatically increases liquidation risk in web version futures trading.

- Ignoring Funding Costs: Holding web version futures trading positions through multiple funding periods accumulates costs. Factor these into your position management decisions.

- Neglecting Liquidation Prices: Always know where your liquidation price sits in web version futures trading. If it’s too close to market prices, your position faces excessive risk.

- Impulsive Trading: The ease of web version futures trading execution shouldn’t encourage impulsive decisions. Every position should be based on analysis and a clear thesis.

- Excessive Risk Per Trade: Professional web version futures trading typically risks no more than 1-2% of capital per trade. Conservative risk management ensures longevity.

- Overlooking Fee Impact: While SunCrypto’s new fee structure is highly competitive, fees still matter, especially for high-frequency web version futures trading strategies. Always factor costs into your expected returns.

- Emotional Decision-Making: Fear and greed are poor guides in web version futures trading. Stick to your predetermined strategy regardless of short-term outcomes.

The Future of Web Version Futures Trading in India

SunCrypto’s comprehensive web version futures trading platform represents more than a technological upgrade—it signals the continued maturation of India’s cryptocurrency ecosystem. As regulatory clarity emerges and more Indians embrace digital assets, robust web version futures trading infrastructure becomes increasingly essential.

The platform demonstrates commitment to meeting traders where their needs lie. By offering seamless integration between mobile and web version futures trading experiences, combined with one of the most competitive fee structures in the industry, SunCrypto acknowledges that modern traders require both flexibility and economic efficiency.

Looking forward, we can anticipate further innovations in web version futures trading for the Indian market. Enhanced analytical tools, more sophisticated order types, improved social trading features, and deeper integration with traditional financial systems all represent potential developments that will make web version futures trading increasingly accessible to mainstream Indian investors.

Final Thoughts

The launch of SunCrypto’s web version futures trading platform marks a significant milestone for Indian cryptocurrency traders. By combining proven mobile functionality with the analytical power and comfort of desktop trading, enhanced by a revolutionary fee structure that rewards active participation, SunCrypto has created a comprehensive web version futures trading environment that serves all experience levels.

The journey from first login to confident web version futures trading need not be intimidating. The intuitive dashboard, comprehensive charting tools, robust risk management features, seamless fund transfers, and dramatically reduced fee barriers create a workflow that feels natural even for traders new to web version futures trading platforms.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.

Yes