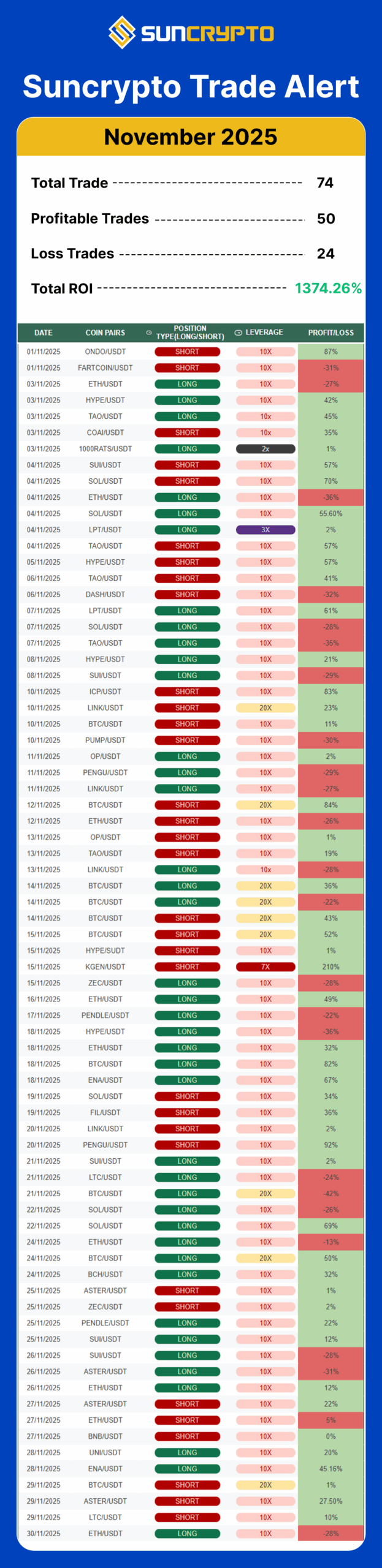

In November, investors on the SunCrypto platform achieved an astounding Return on Investment (ROI) 1300%+ through our expert-guided Futures Trading alerts. This incredible figure is a 100%+ increase over the october’s high of 1200%! November Crypto pnl report concluded with an extraordinary performance, with +1,374.26% cumulative Net Profit across total 74 futures trades. The report highlights a highly profitable and consistent trading strategy, boasting a remarkable win Rate of 67.57%.

Key Performance Metrics for November PNL Crypto Report

The PNL report for November reveals several impressive statistics, confirming the strength and consistency of the trading strategy:

|

Metric |

Value |

Interpretation |

|

Total Trades |

74 |

High activity demonstrating robust and consistent market participation. |

|

Profitable Trades |

50 |

An impressive volume of successful trades, securing gains across the portfolio. |

|

Losing Trades |

24 |

Losses were tightly controlled and managed, resulting in a low overall impact. |

|

Win Rate |

67.57% |

Superior consistency, with over two out of every three trades closing in profit. |

|

Total Net Profit |

+1,374.26% |

Exceptional cumulative Return on Investment (ROI) for the month. |

The foundation of this stellar performance is the 67.57% Win Rate, indicating that the core trading strategy is robust and effective, particularly in capturing trend movements. This tremendous success wasn’t accidental. It was the direct result of following and learning from our precise Futures Trading alerts. Our users didn’t just blindly execute trades; they understood the logic and analysis behind each alert.

Analysis of Winning Strategy and PNL Crypto Report Formula

The key to the November success was strategic flexibility and precise execution across varying risk parameters.

Consistent Leverage and Trade Direction

The report highlights a flexible approach to risk, with leverage ranging from 3x to 20x across different trades, indicating a tailored approach based on the perceived stability and volatility of the asset. The PNL success was well-balanced between Long (Bullish) and Short (Bearish) positions, confirming the strategy’s adaptability to any market condition.

- Key Profitable Trades: The report shows massive gains in assets like PENGU/USDT (+92%) from a Short trade, a strong ENA/USDT Long trade (+67%), and a notable SOL/USDT Long trade (+62%).

- Altcoin Momentum Capture: The strategy excelled in capturing sudden, significant moves in various altcoins, including the volatile SOL/USDT pair, highlighting strong market scanning and rapid entry execution.

Focus on Diversity

The trading desk successfully diversified its exposure across numerous pairs, mitigating the risk associated with over-reliance on a single asset. Pairs traded ranged from established crypto assets to newer tokens like HYPE/USDT and PENGU/USDT, ensuring the desk capitalized on momentum wherever it appeared.

Risk Management and Drawdowns in the November PNL Crypto Report

While the overall results are overwhelmingly positive, the PNL report also includes data on drawdowns, which underscores the inherent risk management discipline in leveraged futures trading:

- The largest single loss came from a FART/USDT Short trade, losing 32%, closely followed by a significant BTC/USDT Long loss of 42%.

- It is crucial to note that despite these sharp losses, the trades were quickly followed by high-profit entries. This rapid recovery mechanism and the overwhelming volume of profitable trades (50 wins vs. 24 losses) showcases the importance of position sizing and stop-loss discipline to prevent single losses from crippling the overall portfolio.

Navigating a Challenging Market

If we look at the broader crypto market in November, the conditions were exceptionally tough. Bitcoin (BTC) saw a significant downtrend of -17.67%. The market was difficult and highly strategic trading was required to generate returns.

However, our team of trade experts successfully navigated this volatile environment by trading key levels:

- When the market trended down: We focused on short calls.

- When the market hit support levels: We executed a mixed strategy of both long and short calls.

The November trades were, therefore, a perfect blend of long and short positions, dictated purely by market movement.

Breaking the Trading Myth

This stellar performance serves to shatter a common misconception in trading: the myth that long calls are inherently better than short calls, causing traders to favor them.

Our results clearly demonstrate that long and short positions are equally important. The key to success is to trade in the direction the market is moving, regardless of whether that means going long or short.

Our standout trade of the month was on KGEN/USDT, a single short call that delivered a massive 210% profit!

Bonus Tip

If you are eager to learn from these powerful trading alerts and analysis and generate such bumper returns from the market, here’s how you can start:

- Download the SunCrypto app [Click here]

- Join our exclusive Futures Trading alerts WhatsApp group [Click here]

- Subscribe to our YouTube channel, where we regularly host live streams to educate beginners and discuss all your market queries live. [Click here]

Conclusion

SunCrypto’s November performance report sets a new, high benchmark for futures trading. The +1,374.26% cumulative net profit and a 67.57% Win Rate attest to a highly skilled and disciplined trading methodology. The combination of calculated leverage, asset diversity, and a strategic balance of long and short positions allowed the desk to capitalize on a dynamic and volatile market throughout the month. This outstanding November PNL crypto report proves the strategy’s effectiveness.

Disclaimer: Crypto products & NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.

How can I invest in Suncryto ?

Very good

I want shiba inu to go up to 1 dollar