At SunCrypto, we’ve heard your feedback and are excited to introduce a new and improved crypto fee structure for our INR and USDT futures markets. This isn’t just a small change—it’s a major upgrade designed to make high-volume trading benefits accessible to everyone, from beginners to experienced traders.

Upgraded VIP Program and Crypto Fee Structure

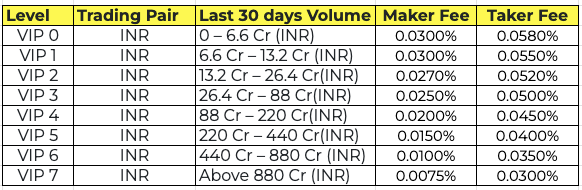

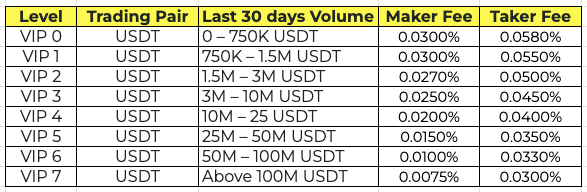

Our new crypto fee structure streamlines the VIP program across Levels 0 to 7, offering steeper discounts on maker and taker fees for both INR and USDT markets.

As you advance through the levels, your fees drop significantly. For example, the Crypto Futures INR taker fee starts at 0.0300% at VIP Level 0 and goes as low as 0.0075% at the top VIP Level 7, and vice versa for Crypto Futures USDT.

The best part? We’ve dramatically lowered the 30-day trading volume requirements to maintain each VIP level—by almost 10 times.

Why Did SunCrypto Make This Change?

Our previous crypto fee structure had a significant drawback: the 30-day trading volume thresholds were extremely high. For instance, to be at VIP Level 0, you needed a massive trading volume of over ₹17.6 crore. This was a huge barrier, even for dedicated traders, making it difficult to progress and earn fee reductions.

We recognized that our traders needed a system that would fuel their success, not hold them back. This new structure is our solution, designed to make rewards more attainable and your trading journey more rewarding.

Types of Crypto Fees Structure on SunCrypto

SunCrypto primarily has three types of fees: spot trading fees, and futures trading fees. These fees are designed to cover the costs of using the platform and processing transactions.

-

- Spot Trading Fees: This is the fee charged when you buy or sell cryptocurrencies. SunCrypto’s trading fee is 0.5% on the buy and sell of the transaction amount. The 0.5% fee applies to the majority of coins, and the trading fee is including of 18% GST.

- Example: If you buy Bitcoin worth ₹10,000, a trading fee of 0.2% would be ₹20.

- Withdrawal Fees: This fee is for moving crypto assets from your SunCrypto wallet to an external wallet. SunCrypto’s support page states that the exchange itself does not charge a withdrawal fee. However, a separate network fee is charged.

- Futures Trading Fees: A tiered fee structure for futures trading is common among cryptocurrency exchanges. It works by rewarding traders with lower fees as their trading volume increases. This model is often referred to as a maker-taker model.

- Spot Trading Fees: This is the fee charged when you buy or sell cryptocurrencies. SunCrypto’s trading fee is 0.5% on the buy and sell of the transaction amount. The 0.5% fee applies to the majority of coins, and the trading fee is including of 18% GST.

How It Works: Maker and Taker Fees?

- Maker Fee: This is the fee charged when you place a limit order that is not immediately filled. By adding an order to the order book, you are “making” liquidity, and exchanges often reward this behavior with lower fees.

- Taker Fee: This is the fee charged when you place a market order that is filled instantly by an existing order on the book. You are “taking” liquidity, and these fees are typically higher than maker fees.

Example:

- You are a VIP 0 trader with a 30-day trading volume of $500,000.

- You place a market order to buy a futures contract worth $10,000.

- Since you are a taker, your fee would be 0.080%. The total fee would be $10,000 * 0.00080 = $8.

Now, imagine your trading volume increases to $1.8 million over the next 30 days, moving you to VIP 2.

- You place another market order to buy a futures contract worth $10,000.

- Your new taker fee is 0.060%. The total fee would be $10,000 * 0.00060 = $6.

As you can see, by moving up to a higher VIP level, your trading fees are reduced, allowing you to save money on every trade. This tiered system incentivizes higher trading volume by rewarding users with lower costs.

How Does This Benefit You?

The new crypto fee structure is built to enhance your futures trading experience and boost your portfolio. Here’s what you can expect:

- Easier VIP Progression: With significantly reduced volume requirements, you can move up VIP levels and unlock benefits much faster.

- Greater Savings: Enjoy up to a 77% trading fee discount at higher VIP levels, which directly increases your net returns on every trade.

- More Frequent Rewards: Lower thresholds mean you reach new milestones and get rewarded with fee deductions more quickly.

- A Stronger Community: By making futures trading more accessible, this update helps grow and strengthen the SunCrypto community.

- Better Risk Management: Lower fees allow you to diversify your positions without worrying about high costs, helping you navigate volatile crypto markets with confidence.

Conclusion

SunCrypto’s new crypto fee structure is now live, transforming futures trading from a high-stakes challenge into a rewarding journey. By addressing the issues of the old structure and boosting your benefits, we’re not just updating our fees—we’re upgrading your entire trading experience.

Disclaimer: Crypto products & NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. The information and material contained herein are subject to change without prior notice including prices which may fluctuate based on market demand and supply. We strongly encourage you to conduct independent research, exercise caution, and invest only after proper due diligence.

Frequently Asked Questions

Q1: What is the main difference between the old and new futures fee structures?

The main difference is the drastic reduction (almost 10x) in the 30-day trading volume required to achieve and maintain all VIP levels (0-7). This makes it significantly easier and faster for regular traders to access lower maker and taker fees.

Q2: What are “Maker” and “Taker” fees?

a. Maker Fee: Charged when you place a limit order that is not immediately matched, thus adding liquidity to the order book. Makers generally pay lower fees.

b. Taker Fee: Charged when you place a market order or a limit order that is immediately matched, thus removing liquidity from the order book.

Q3: How much can I save with the new fee structure?

Traders at the highest VIP level (VIP 7) can enjoy a discount of up to 77% on their trading fees compared to the initial VIP 0 rate. For instance, the INR Taker fee can drop from 0.0300% to as low as 0.0075%.

Q4: How do I progress to a higher VIP level?

You progress to a higher VIP level based on your 30-day trading volume (in both INR and USDT futures markets). SunCrypto has made the volume requirement for each level substantially lower than before. You can check the detailed requirements on the official SunCrypto fee structure page.

Q5: Does this new fee structure apply to both INR and USDT Futures trading?

Yes, the new streamlined VIP program and the reduced maker/taker fees apply equally to both the INR futures market and the USDT futures market on the SunCrypto platform.

Q6: How does this change benefit a beginner futures trader?

For beginners, the benefit is significant:

a. Faster Rewards: They can reach the first few VIP levels and unlock fee discounts much sooner than under the old structure.

b. Lower Cost for Learning: The reduced fees make the initial phases of futures trading less expensive, allowing them to practice and diversify strategies more affordably.