The cryptocurrency market has been gripped by a wave of intense selling pressure and liquidation, culminating in one of the most brutal 24-hour periods for leveraged traders in recent memory. Over $2.3 billion in crypto positions, predominantly bullish “longs,” were forcibly closed across major exchanges, sending Bitcoin (BTC) plummeting below critical support levels and dragging the broader market into a deep red abyss.

This deleveraging event, a term used to describe the mass unwinding of borrowed funds, serves as a stark reminder of the inherent volatility and risk associated with leveraged trading in digital assets.

What is a liquidation?

Imagine you’re betting that the price of Bitcoin will go up. You put in a small amount of your own money (margin) and borrow the rest to increase your potential profits. This is called a “long” position with leverage. If Bitcoin’s price moves against your bet and falls too far, the exchange will automatically close your position to prevent you from losing more money than you have in your account. This forced closure is a “liquidation,” and you lose your initial margin.

The Scale of the Damage After Liquidation

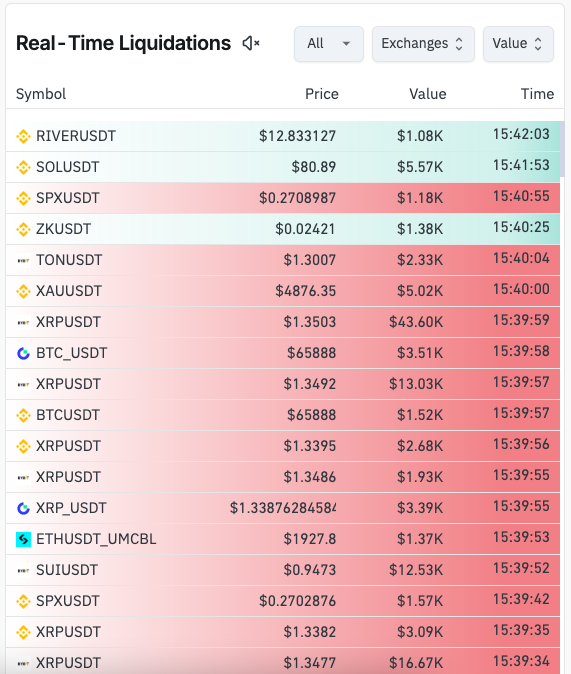

In the past 24 hours, the sheer volume of liquidations has been staggering:

- Total Market Liquidations: Exceeded $2.3 billion, making it one of the largest single-day deleveraging events in the current cycle.

- Bitcoin (BTC): Led the charge with approximately $1.1 billion in liquidated long positions as BTC prices dipped below $60,000 for the first time since October 2024.

- Ethereum (ETH): Suffered around $450 million in liquidations, with its price falling to multi-month lows around $1,850.

- Altcoins: The remainder, roughly $750 million, came from various altcoins, including Solana (SOL), XRP, and Cardano (ADA), which experienced double-digit percentage drops.

The Perfect Factors of Liquidation

Several interconnected forces converged to create this environment of extreme fear and forced selling:

- Breaking the $70,000 Barrier: For weeks, Bitcoin’s price held psychological and technical support around $70,000. This level acted as a critical pivot point for many leveraged long positions. Once it was decisively breached, a cascade of automatic liquidations was triggered. As positions were closed, it added more selling pressure, pushing prices even lower and initiating a domino effect across the market.

- Institutional Outflows and Macro Headwinds: The crypto market hasn’t been immune to broader macroeconomic concerns. January saw significant outflows from spot Bitcoin Exchange-Traded Funds (ETFs), totaling over $3 billion. This suggests that institutional capital, which was a key driver of the market’s rally in late 2025, has been retreating, adding to the selling pressure. The global equity markets, particularly tech stocks, have also faced pressure, often correlating with risk assets like crypto.

- Overleveraged Market: Leading up to this crash, funding rates (the cost of holding leveraged positions) had been consistently positive, indicating an overcrowded market with too many traders betting on higher prices. This made the market particularly vulnerable to a sharp downturn. When prices began to fall, these overleveraged positions were the first to be wiped out.

- Miners and Major Holders Under Pressure: With Bitcoin trading well below its estimated “production cost” (which sits around $87,000, according to some analyses), Bitcoin miners are facing increasingly tight margins. Additionally, large institutional holders who made significant purchases at higher price points are now “underwater,” potentially facing margin calls or being forced to sell to maintain their financial health.

What Does Liquidation Mean for the Market?

The sheer scale of these liquidations has pushed the Crypto Fear & Greed Index to an “Extreme Fear” level of 12. This sentiment gauge, where lower numbers indicate more fear, suggests that the market is currently in a state of capitulation—a point where many investors give up and sell their assets, often at a loss.

Historically, such extreme oversold conditions and massive deleveraging events often precede a market bounce or a period of consolidation. While the immediate outlook remains volatile, many analysts view these “washout” events as necessary purges that can reset the market and lay the groundwork for future recovery.

However, the path forward is likely to be turbulent. Traders will be closely watching for signs of renewed institutional inflows, a stabilization in macroeconomic conditions, and whether Bitcoin can reclaim key psychological levels like $70,000 to signal a potential shift in momentum. For now, caution remains the dominant theme in the digital asset landscape.

Disclaimer: Crypto products & NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.