As of February 2026, recent tranches of unsealed documents (the so-called “Epstein Files“) released by the U.S. Department of Justice have revealed significant and controversial links between Jeffrey Epstein and the early cryptocurrency industry.

Here are the key points regarding Epstein’s involvement in crypto:

Major Investment in Coinbase (2014)

The files confirm that Epstein was an early, indirect investor in Coinbase, now the largest U.S. crypto exchange.

- The Deal: In December 2014, Epstein invested $3 million into Coinbase through a vehicle called IGO LLC.

- The Connection: The investment was facilitated by Brock Pierce (a prominent Bitcoin advocate) via the venture fund Blockchain Capital.

- The Return: Internal valuation reports show Epstein sold half of this stake in February 2018 for $15 million—a 500% return on that portion of his investment.

Funding Bitcoin Core Development

The documents highlight Epstein’s attempts to influence the technical direction of Bitcoin by funding its primary developers.

- MIT Digital Currency Initiative (DCI): Epstein donated over $525,000 specifically to the DCI at the MIT Media Lab.

- Supporting Developers: In 2015, following the bankruptcy of the Bitcoin Foundation, Epstein’s “gift funds” were used to pay the salaries of key Bitcoin Core contributors, including Gavin Andresen, Wladimir van der Laan, and Cory Fields.

- Motivation: Emails suggest Epstein was fascinated by Bitcoin’s potential to bypass national sovereignty and central banks, referring to the “radical” nature of open-source developers.

Links to Blockstream & Industry Pioneers

The files reveal correspondence between Epstein and leaders of Blockstream, a major Bitcoin infrastructure company.

- Austin Hill & Adam Back: Emails from 2014 show Blockstream co-founder Austin Hill and CEO Adam Back in communication with Epstein and Joi Ito regarding seed-round funding.

- The Investment: Epstein indirectly invested $500,000 in Blockstream through a fund managed by Joi Ito.

- St. James Island Meeting: Travel records indicate that Hill and other colleagues visited Epstein’s private island, Little St. James, in April 2014 for business meetings. Blockstream has since stated that the investment was divested in 2015 due to conflicts of interest.

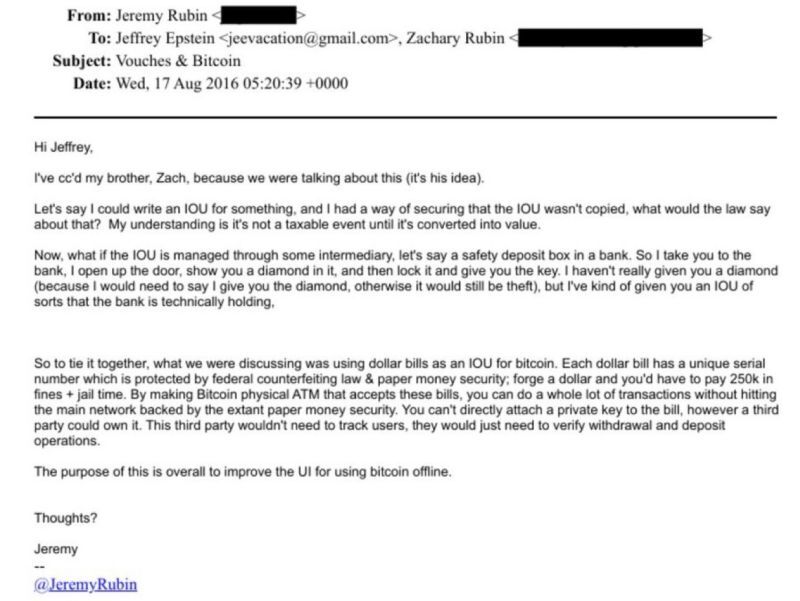

Proposing New Digital Currencies

Epstein didn’t just invest; he actively pitched his own crypto-related ideas.

- “The Sharia” Currency: In 2016 emails to Saudi Arabian officials, Epstein proposed creating a Sharia-compliant digital currency modeled on Bitcoin technology to be used across the Middle East.

- Consulting Tech Titans: Correspondence shows Epstein discussing the intrinsic value of Bitcoin with Peter Thiel and Reid Hoffman (LinkedIn co-founder), attempting to position himself as a bridge between high finance and the emerging tech elite.

The “Voldemort” Protocol

- Joi Ito’s Role: Much of this activity was funneled through Joi Ito, the then-director of the MIT Media Lab.

- Anonymity: Emails revealed that Ito referred to Epstein as “He who shall not be named” or “Voldemort” to hide his identity as a donor, as Epstein had been disqualified from MIT’s official donor database following his 2008 conviction.

Disclaimer: Crypto products & NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.