The decentralized finance (DeFi) revolution is at the heart of Web3, powered by tokens that govern and operate Decentralized Exchanges (DEXs) and other protocols. In 2025, as the cryptocurrency market matures, the demand for decentralized governance, cross-chain interoperability, and efficient token swapping continues to grow, making crypto DEX tokens a critical sector to watch.

For Indian investors, accessing these high-potential decentralized assets has been simplified by platforms like SunCrypto through their SunAlpha feature, which acts as a bridge to the vast, complex DEX market.

Here is a detailed look at 10 prominent decentralized crypto tokens and platforms that should be on the radar in 2025, categorized by their primary function.

Category 1: DEX Infrastructure & Governance Tokens

These tokens represent the backbone of the decentralized trading ecosystem, often allowing holders to participate in protocol governance.

1. Uniswap (UNI)

- The Industry Giant: Uniswap remains the largest and most influential crypto DEX globally, dominating the Ethereum network and expanding across multiple Layer-2 solutions.

- Why It Matters in 2025: As Ethereum continues its scaling efforts and institutional interest grows in DeFi, UNI’s role as the governance token for the most liquid decentralized exchange remains foundational. Continued innovation in its Automated Market Maker (AMM) model ensures its dominance.

2. PancakeSwap (CAKE)

- The BNB Chain Leader: PancakeSwap is the leading DEX on the BNB Chain (formerly Binance Smart Chain). It is a community-focused platform offering farming, staking, and lottery features.

- Why It Matters in 2025: Its massive user base and low transaction fees (relative to Ethereum) make it the gateway for DeFi access for millions of users worldwide, particularly those seeking high-yield opportunities on BNB Chain.

3. dYdX (DYDX)

- Decentralized Derivatives: dYdX stands out as a leading decentralized perpetuals and derivatives exchange. Unlike AMM-based spot DEXs, dYdX utilizes an order-book model for more sophisticated, high-leverage trading.

- Why It Matters in 2025: As institutional and professional traders seek transparent, non-custodial alternatives to centralized crypto futures platforms, dYdX is well-positioned to capture significant volume in the growing decentralized derivatives space.

Category 2: Cross-Chain Interoperability & Aggregators

These projects focus on connecting disparate blockchains and optimizing trade execution.

4. 1inch Network (1INCH)

- The DEX Aggregator: 1inch is not a single DEX but a powerful DEX aggregator. It scans prices across various decentralized exchanges to find the most efficient and cost-effective trading route for the user.

- Why It Matters in 2025: With liquidity fragmented across dozens of chains and hundreds of DEXs, aggregators like 1inch are crucial tools for achieving the best execution price and minimizing slippage, making the crypto DEX ecosystem usable.

5. THORChain (RUNE)

- Native Asset Swapping: THORChain is a unique decentralized liquidity protocol that allows users to swap native cryptocurrencies (like BTC for ETH) without needing wrapped tokens or bridges.

- Why It Matters in 2025: RUNE solves one of the biggest problems in DeFi—the need for trustless, cross-chain swaps of native assets. As interoperability becomes a core trend, THORChain’s unique architecture provides a necessary solution.

Category 3: High-Throughput Layer-1 Ecosystems (DeFi Hubs)

These tokens represent the Layer-1 networks that host rapidly growing decentralized ecosystems.

6. Solana (SOL)

- The Speedster: While not strictly a DEX token, Solana is a major Layer-1 platform that has fostered a massive decentralized ecosystem, including leading DEXs like Raydium and Orca.

- Why It Matters in 2025: Solana’s high throughput (speed) and extremely low transaction costs have made it the network of choice for many consumer-facing applications, GameFi, and liquid staking protocols. Its token is essential for accessing this high-growth DeFi ecosystem.

7. Avalanche (AVAX)

- Subnet Innovation: Avalanche is known for its ability to launch custom, application-specific blockchains called “Subnets,” providing a highly scalable infrastructure for decentralized applications and institutional finance.

- Why It Matters in 2025: The token is critical for security and transaction fees within its C-Chain and P-Chain. Its flexible structure is key to attracting large enterprises and custom DeFi projects looking for dedicated, powerful decentralized environments.

Category 4: Specialized DeFi & Liquidity

These tokens focus on unique niches within the DeFi sector, often dealing with efficient stablecoin trading or liquidity provision.

8. Curve DAO (CRV)

- Stablecoin King: Curve Finance specializes in creating deep liquidity pools for trading stablecoins and pegged assets (like different forms of wrapped Bitcoin).

- Why It Matters in 2025: CRV is vital infrastructure. Its design minimizes slippage for large stablecoin swaps, making it essential for institutional DeFi flows and a foundational piece of the entire decentralized lending and borrowing ecosystem.

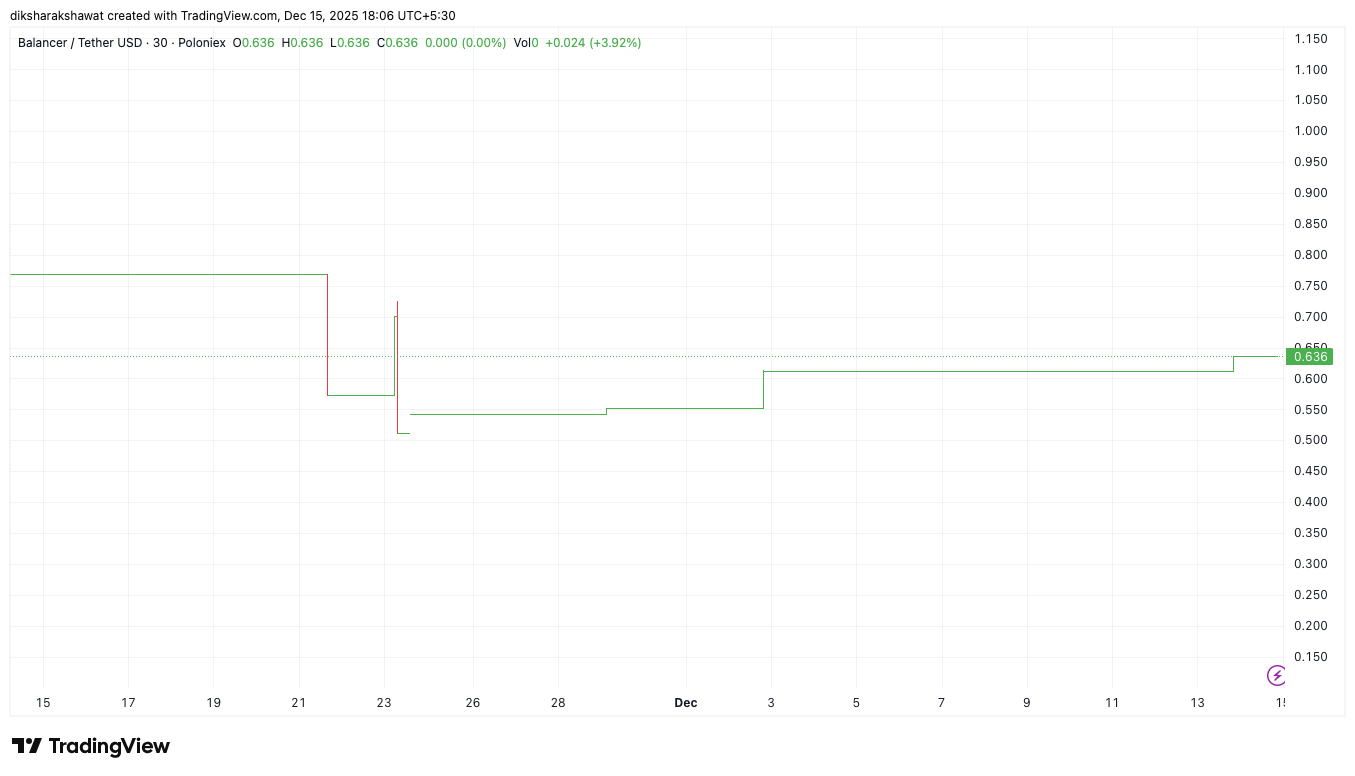

9. Balancer (BAL)

- Flexible AMM: Balancer allows users to create custom liquidity pools with up to eight tokens, functioning as an automated portfolio manager as well as a DEX.

- Why It Matters in 2025: The BAL token governs this highly customizable platform. Its flexible pool architecture is key for complex portfolio rebalancing and treasury management within decentralized organizations (DAOs).

10. Jupiter (JUP)

- Solana Aggregator: Jupiter is the leading DEX aggregator on the Solana network, similar to how 1inch works on Ethereum and other EVM chains.

- Why It Matters in 2025: As Solana’s trading volume soars, Jupiter ensures users get the best possible execution across all Solana DEXs (Raydium, Orca, etc.). Its native token is central to decentralized governance and incentivizing liquidity on the fastest-growing major blockchain.

Accessing Crypto DEX Tokens via SunCrypto

The most significant hurdle for Indian investors in accessing these diverse tokens is the complexity of decentralized wallets, gas fees, and cross-chain transfers.

SunCrypto’s SunAlpha feature directly addresses this by acting as a CEX-DEX bridge. It aggregates liquidity from major crypto DEX protocols, allowing users to purchase tokens like UNI, CAKE, or SOL directly using their INR balance on the SunCrypto app, without the need for manual wallet management. This makes the volatile yet promising world of decentralized finance accessible to every Indian trader.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.