For many, the idea of “timing the market” to buy at the perfect low and sell at the perfect high is a daunting, if not impossible, task. This is where the concept of a Systematic Investment Plan (SIP) comes into play, offering a disciplined and strategic approach to navigate the unpredictable crypto landscape.

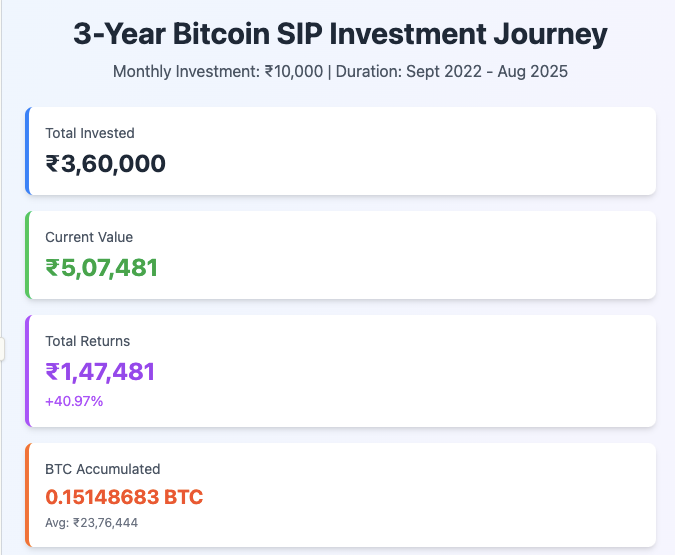

I discovered the power of crypto SIP after my uncle shared his successful 3-year investment journey, showing how investing ₹10,000 monthly in Bitcoin consistently built substantial wealth through market ups and downs. Inspired by this disciplined approach, I started my own ₹15,000 monthly crypto SIP, confidently buying through market volatility and steadily accumulating assets using rupee-cost averaging for long-term wealth creation.

Key Results:

- Total Invested: ₹3,60,000 (36 months × ₹10,000)

- Current Portfolio Value: ₹10,03,968

- Total Returns: ₹6,43,968 (+178.88%)

- Bitcoin Accumulated: 0.29968293 BTC

- Average Purchase Price: ₹12,01,201 per BTC

A Crypto SIP, much like its traditional counterpart in stocks or mutual funds, involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This article will serve as a detailed guide for anyone in India looking to start a Crypto SIP in both Indian Rupees (INR) and the popular stablecoin, USDT. We will delve into the core principles, provide a step-by-step process, analyze the benefits and drawbacks, and explore the data analytics that underscore its effectiveness.

The Core Principles of a Crypto SIP

At its heart, a Crypto SIP is an investment strategy built on two fundamental pillars: dollar-cost averaging (or rupee-cost averaging in India) and discipline.

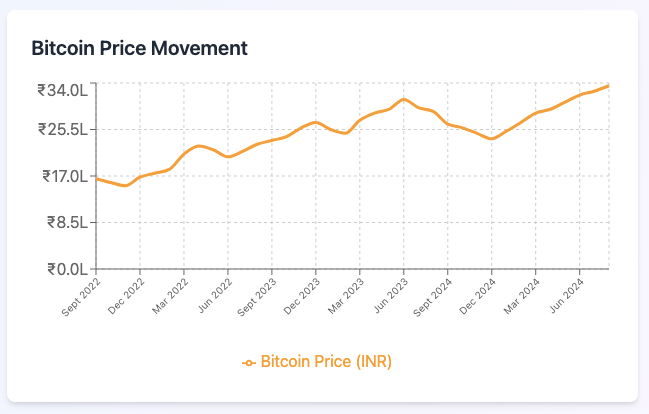

Rupee-Cost Averaging (RCA): The Market’s Antidote

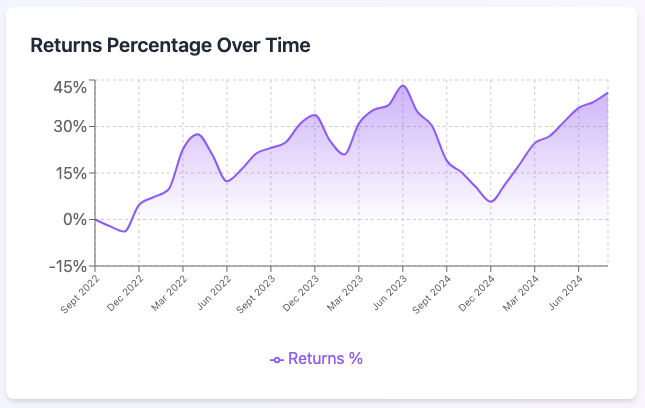

The primary advantage of a SIP is its ability to mitigate the risk associated with market volatility through rupee-cost averaging. This principle works by averaging out the cost of your investment over time.

- When prices are high: Your fixed investment amount buys fewer units of the cryptocurrency.

- When prices are low: The same fixed amount buys more units of the cryptocurrency.

Over a long-term investment horizon, this strategy ensures that your average purchase price is lower than if you had bought all at once during a market peak. It removes the need to time the market, which is a significant source of stress and risk for most investors. Instead of agonizing over “Is now a good time to buy?” you simply stick to your schedule.

The Power of Discipline

A SIP instills a habit of regular saving and investing. In the highly emotional and news-driven crypto market, this discipline is invaluable. It helps investors avoid impulsive decisions driven by fear (selling during a crash) or greed (buying during a frenzy). By automating your investments, you remove emotion from the equation, allowing your strategy to work consistently in the background.

How to Start a Crypto SIP in India? (INR and USDT)

Starting a Crypto SIP in India is a straightforward process, thanks to the increasing number of user-friendly platforms. The process is similar for both INR and USDT, with a few key differences.

Step 1: Choose a Crypto Exchange with SIP Functionality

The first and most crucial step is to select a reliable and regulated cryptocurrency exchange that offers a SIP feature. Look for platforms that are registered with the Financial Intelligence Unit (FIU) of India, as this ensures compliance with local regulations.

- Platforms for INR-based SIPs: Exchanges like SunCrypto have a strong presence in the Indian market and offer seamless INR deposit and withdrawal options. They typically allow you to set up a recurring investment plan using UPI or bank transfers.

- Platforms for USDT-based SIPs: While INR-based platforms are common, many international exchanges also support USDT. USDT, or Tether, is a stablecoin pegged to the US dollar, making it a popular choice for traders who want to maintain a stable value for their funds. To use USDT for a SIP, you’ll first need to acquire it, either through a P2P (Peer-to-Peer) transaction on an exchange like Binance or by converting your INR to USDT on a platform that supports this.

Step 2: Complete Your KYC (Know Your Customer) Verification

For any regulated exchange, KYC is a mandatory step to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. You will typically need to provide:

- PAN Card

- Aadhar Card

- Proof of address (utility bill, bank statement, etc.)

- A selfie or video verification

This process is generally quick and once completed, allows you to deposit funds and begin trading.

Step 3: Fund Your Account

This is where the INR and USDT paths diverge slightly.

- For INR-based SIP: Link your bank account and deposit funds into your exchange wallet using a supported method like UPI, IMPS, NEFT, or bank transfer. Most Indian exchanges have made this process very user-friendly.

- For USDT-based SIP: If you are starting with INR, you will need to buy USDT on the platform. Once you have a balance of USDT, you can use it to set up your SIP. Some platforms may allow you to directly set up a recurring purchase using your credit card or other payment methods, but this often comes with higher fees.

Step 4: Set Up Your SIP

Navigate to the SIP or “Auto-Invest” section of the exchange. Here, you will define the parameters of your SIP:

- Select the cryptocurrency: Choose the crypto you want to invest in. Common choices include Bitcoin (BTC) and Ethereum (ETH), as they are the largest and most established cryptocurrencies.

- Specify the investment amount: Enter the amount you want to invest in each installment (e.g., ₹1,000 or 10 USDT). Many platforms allow you to start with a minimum as low as ₹100.

- Set the frequency: Choose how often you want the investment to occur. This can be daily, weekly, or monthly.

- Automate the process: Confirm the settings, and the exchange will automatically debit the specified amount from your wallet at the chosen frequency and buy the cryptocurrency for you.

Advantages and Disadvantages of a Crypto SIP

Understanding the pros and cons is crucial for any investment strategy.

Advantages of Crypto SIP

- Mitigates Volatility Risk: As discussed, rupee-cost averaging significantly reduces the risk of buying at market peaks.

- Promotes Discipline: It removes the emotional element of investing, encouraging a consistent and long-term approach.

- Affordability: You can start with a small amount of money, making crypto investment accessible to a wider audience.

- Convenience: The automated nature of SIPs means you “set and forget.” You don’t need to constantly monitor the market.

- Compounding Effect: By reinvesting returns, you can potentially benefit from the power of compounding over time, which can significantly multiply your wealth in the long run.

Disadvantages of Crypto SIP

- Limited Gains in a Bull Market: In a strong and sustained bull run, a lump-sum investment made at the beginning would likely outperform a SIP. SIPs are designed for long-term averaging, not for maximizing short-term gains.

- No Protection from a Bear Market: While a SIP helps average down your cost, it does not prevent the value of your portfolio from dropping during a prolonged bear market. Your investment could still be in the red for a significant period.

- Limited Availability: While growing, the SIP feature is not available for all cryptocurrencies on all exchanges. The selection is often limited to the most popular coins.

- Withdrawal Fees and Taxes: In India, crypto gains are taxed at a flat 30%, regardless of the holding period. You also have to pay a 1% TDS (Tax Deducted at Source) on every transaction. These costs can eat into your returns.

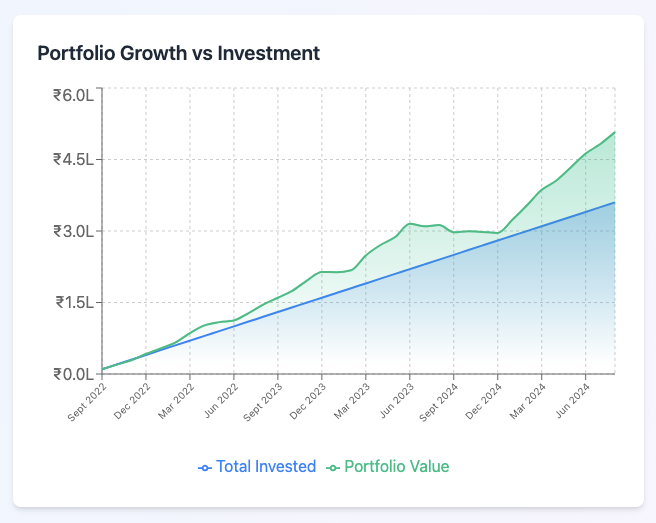

Data Analytics on Crypto SIP

Data analytics provides a powerful way to understand the performance of a SIP versus a lump-sum investment. While historical performance is not a guarantee of future returns, it offers valuable insights.

Hypothetical Scenarios and Performance Analysis

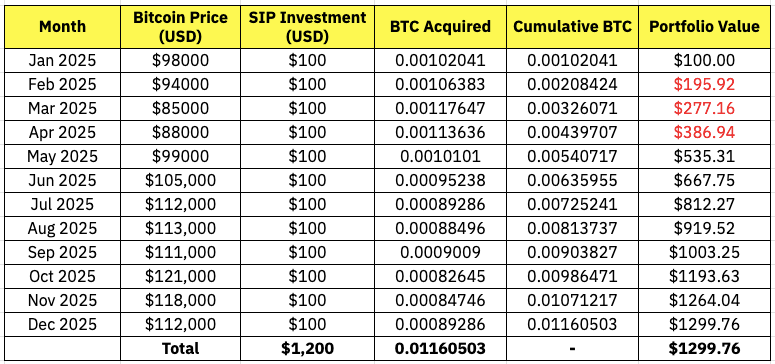

USD Investment Scenario:– Let’s consider a hypothetical scenario: an investor, Rohan, decides to invest in Bitcoin. He has $1,200 to invest in the whole year. Rohan invests $100 every month for 12 months, starting January 2025, he started investing when BTC was approx $98,000.

SIP Performance (December 2025):

- Total Investment: $1,200

- Cumulative BTC Acquired: 0.01160503 BTC

- Bitcoin Price (Dec 2025): $112,000

- Portfolio Value: $1,299.76

- Return: +8.31%

Result: In this moderately volatile market where Bitcoin ended higher than it started ($98,000 → $112,000), and crypto SIP performed SIP by +8.31%.

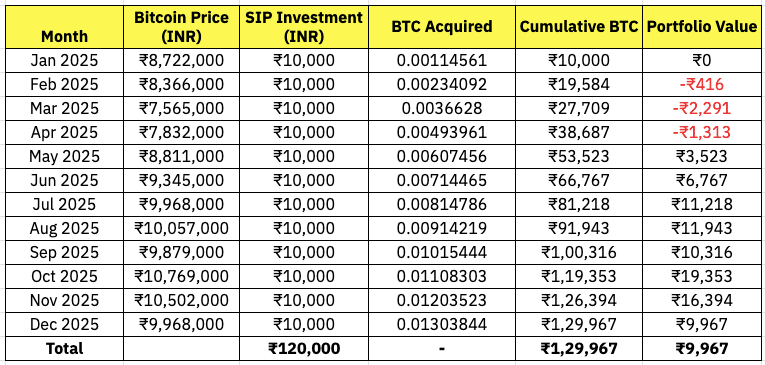

INR Investment Scenario:- Let’s consider the same scenario in Indian Rupees: an investor, Rohan, decides to invest in Bitcoin. He has ₹120,000 to invest. Rohan invests ₹10,000 every month for 12 months, starting January 2025, starting January 2025, he started investing when BTC was approx ₹120,000.

SIP Performance (December 2025):

- Total Investment: ₹120,000

- Cumulative BTC Acquired: 0.01303844 BTC

- Bitcoin Price (Dec 2025): ₹9,968,000

- Portfolio Value: ₹129,967

- Return: +8.31%

Result: In this moderately bullish market where Bitcoin ended higher than it started (₹8,722,000 → ₹9,968,000), and crypto SIP performed SIP by +8.31%.

The Long-Term Perspective

The true power of a SIP is revealed over a long-term horizon (3-5 years or more). Over time, the price fluctuations average out, and the consistent accumulation of assets, particularly during dips, can lead to substantial gains. The compounding effect, where your returns are reinvested to generate more returns, further amplifies this growth.

Using Analytics Tools

Many crypto exchanges and third-party platforms offer analytics tools that allow you to track your SIP performance. These tools can show you:

- Your average purchase price per unit.

- The current value of your portfolio.

- Your total invested amount and total returns.

- A comparison of your SIP performance against a hypothetical lump-sum investment.

These analytics provide a clear, data-driven view of your investment’s health and can help you stay disciplined.

Conclusion

Starting a Crypto SIP in India using INR or USDT is a methodical and disciplined approach to navigating the volatile cryptocurrency market. It is particularly well-suited for beginners and long-term investors who prioritize risk mitigation over chasing short-term gains. By leveraging the principle of rupee-cost averaging, a SIP removes the psychological burden of market timing and fosters a consistent investment habit.

While a SIP may not be the optimal strategy in a sustained bull market, its ability to outperform lump-sum investments during periods of volatility makes it a compelling choice. Before starting, remember to choose a reliable, FIU-registered exchange, complete your KYC, and understand the tax implications of your investments.

Ultimately, the key to success in crypto investing, regardless of the strategy, is to do your own research, invest only what you can afford to lose, and stay committed to a long-term vision. A Crypto SIP provides a robust framework for doing just that, transforming a high-risk, high-reward asset class into a more structured and manageable path to potential wealth creation.

Frequently Asked Questions

1. What is Crypto SIP?

SIP, or Systematic Investment Plan, is a method of investing that involves regularly contributing a fixed amount of money at scheduled intervals, such as monthly or quarterly, rather than making a lump-sum investment. This Crypto SIP aims to average out investment costs over time. It allows you to buy a fixed amount every month and let the market do its work, helping to beat market volatility.

2. What is the minimum amount to start a crypto SIP?

The minimum investment varies by platform:

1. SunCrypto: You can start SIP with any amount between ₹500 (minimum) and ₹50,000 (max) on a weekly frequency basis.

2. General range: Investors can choose their preferred installment starting with an amount as low as ₹500.

3. How does crypto SIP work?

Crypto SIP is a systematic method of investing fixed amounts of money periodically. It is a plan in which you can make equal payments to CRYPTO now and then without worrying about the market. The process involves automatic investment at regular intervals, helping to average out the purchase price over time.

4. Which cryptocurrencies can I invest in through SIP?

Most platforms offer crypto SIP for major cryptocurrencies including:

Bitcoin (BTC)

Ethereum (ETH)

Other 600+ altcoins

Top performing Meme tokens, RWA, DeFi etc.,

5. How to start a crypto SIP?

The first step is to find a platform that supports automated crypto SIP features. Make sure it offers a user-friendly interface, strong security measures, and clear investment options. Key steps include:

1. Choose SunCrypto, a reliable crypto exchange that offers SIP

2. Complete KYC verification

3. Set up your investment amount and frequency

4. Select Your Cryptocurrencies: Research and select the cryptocurrencies you want to invest in

5. Set up automatic bank mandate for payments

6. What are the benefits of crypto SIP?

Key advantages include:

1. Rupee Cost Averaging: Reduces impact of market volatility

2. Convenience: Crypto SIP is a hassle-free process as the amount is automatically debited from a fiat wallet and invested in the scheme chosen by the investor

3. Disciplined Investing: Encourages regular investment habits

4. Flexibility: Investors can choose their preferred installment

5. No Lock-In periods on most platforms

7. What frequency options are available for crypto SIP?

Common frequency options include:

a. Daily

b. Weekly

c. Monthly

d. Quarterly

Monthly contributions are common, but you can choose any frequency that suits your needs.

8. Can I modify or stop my crypto SIP anytime?

Most platforms offer flexibility to:

a. Modify investment amounts

b. Change frequency

c. Pause or stop SIP anytime

d. Switch between different cryptocurrencies

e. No Lock-In restrictions apply

9. Is crypto SIP safe?

Safety depends on:

1. Choosing regulated and compliant exchanges

2. Platform security measures

3. Your own security practices (OTP authentication, MPIN setup and secure passwords)

4. Understanding that crypto investments carry inherent market risks

10. How to calculate potential returns from crypto SIP?

Use a SIP calculator online to project potential investment value based on amount, duration, and assumed rate of return. Many crypto platforms provide built-in calculators to estimate potential returns based on historical performance.

11. What’s the difference between crypto SIP and lump-sum investment?

1. SIP: Spreads investment over time, reduces timing risk, enables rupee-cost averaging

2. Lump-sum: Invests entire amount at once, higher timing risk but potentially higher returns if market timing is good

12. Can I do Crypto SIP for multiple cryptocurrencies simultaneously?

Yes, SunCrypto platform allow you to set up multiple SIPs for different cryptocurrencies, enabling portfolio diversification across various digital assets.

13. Are there any fees associated with crypto SIP?

Fees vary by platform and may include:

1. Transaction fees for each SIP installment

2. Platform charges

3. Withdrawal fees

4. Network/blockchain fees

14. What happens if I miss a Crypto SIP payment?

Most platforms handle missed payments by:

1. Skipping that installment

2. Attempting to debit again after a few days

3. Allowing manual payments to catch up

4. No penalties for missed payments typically

15. Should beginners start with crypto SIP?

Start early investing as soon as possible to benefit from the power of compounding. Set clear goals to define your financial objectives to determine the appropriate investment horizon and risk tolerance.

SIP is often recommended for beginners because it:

1. Reduces the need for market timing

2. Encourages disciplined investing

3. Allows starting with small amounts

4. Provides learning experience over time

These questions reflect the most common concerns and interests of investors looking to start their cryptocurrency investment journey through systematic investment plans.